Lucid Group (NASDAQ:LCID), the manufacturer of Lucid Air electric vehicles, is now under an active investigation by the US Securities and Exchange Commission (SEC).

As per the Form 8-K filed by Lucid Group, the company has received a subpoena for additional documents in relation to an investigation by the SEC:

“On December 3, 2021, Lucid Group, Inc. (the “Company”) received a subpoena from the Securities and Exchange Commission (the “SEC”) requesting the production of certain documents related to an investigation by the SEC. Although there is no assurance as to the scope or outcome of this matter, the investigation appears to concern the business combination between the Company (f/k/a Churchill Capital Corp. IV) and Atieva, Inc. and certain projections and statements. The Company is cooperating fully with the SEC in its review.”

While the scope of this investigation is as yet uncertain, readers should note that Churchill Capital Corp. IV (CCIV) – the SPAC that merged with Lucid Motors to form Lucid Group – faced a number of class-action lawsuits from disgruntled investors. These lawsuits pinpointed identifiable instances where Churchill Capital IV’s disclosures regarding Lucid Motors’ ability to deliver fell short. These included:

- Lucid Motors was not prepared to deliver vehicles by spring of 2021

- Lucid Motors was projecting production of 557 vehicles in 2021 instead of the 6,000 vehicles touted in the runup to the merger with Churchill

- As a result of the foregoing, Defendants’ positive statements about the company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis

Bear in mind that Lucid Group has since then scaled down its delivery commitments for 2021 to 520 units. However, as we noted last week, isolated anecdotes on social media indicate that some customers who had pre-ordered the Air Dream Edition EV are facing inexplicable delivery delays. This means that the company might not be able to meet even this scaled-down delivery commitment for 2021.

During its first earnings call, Lucid Group’s CEO Peter Rawlinson had reiterated the commitment to deliver 20,000 units in 2022. However, Rawlinson had also identified supply chain constraints as a threat to this target.

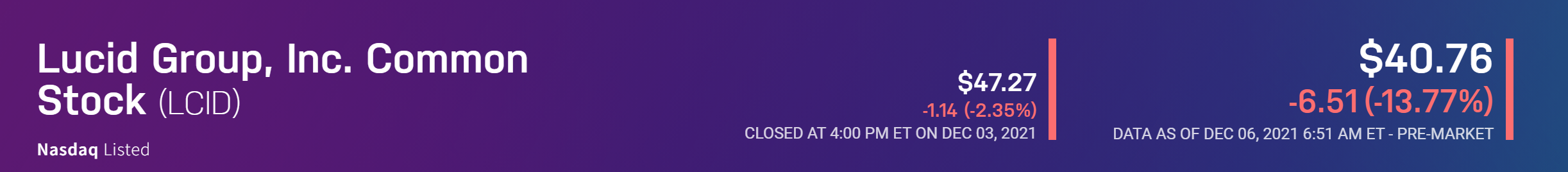

Source: https://www.nasdaq.com/market-activity/stocks/lcid

Source: https://www.nasdaq.com/market-activity/stocks/lcid

Lucid Group shares are experiencing a bloodbath currently, with the stock now down over 13 percent in pre-market trading. Given the dearth of pertinent information, this appears to be a knee-jerk reaction at the moment.

The post Lucid Group (LCID) Shares Face a Bloodbath Now That the Company Is Under an Active Investigation by the SEC by Rohail Saleem appeared first on Wccftech.