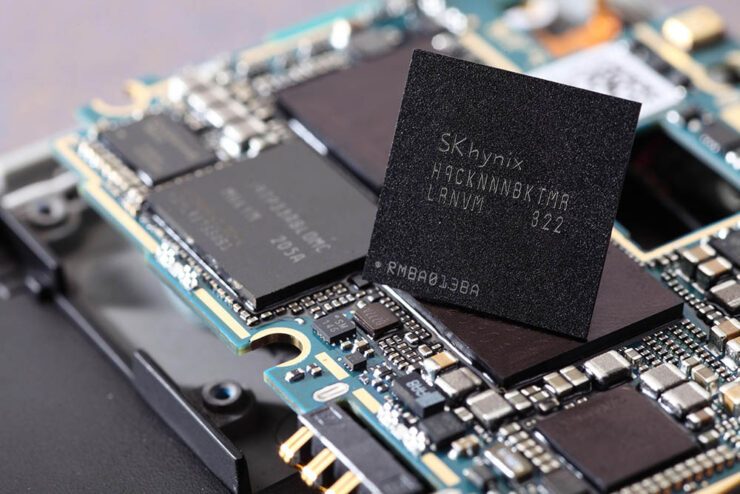

Unnamed analysts quoted by Korean publication Business Korea believe that U.S. chipmaker Intel Corporation’s $9 billion sale of its memory fabrication facilities to South Korean memory manufacturer SK Hynix is likely to be approved by Chinese authorities by the end of this year. The sale has been approved by authorities in the U.S., South Korea and the United Kingdom, after being scrutinied for anticompetitive risks. The potential Chinese approval also signals that Intel’s smaller rival, Advanced Micro Devices, Inc (AMD) might also secure the go-ahead for its bid to acquire configurable integrated circuit designer Xilinx. However, a report by PaRR states that a confirmation for AMD is not guaranteed as of yet.

Intel’s SK Hynix Sale On Track For December 2021 Approval Believes Korean Publication

Should Intel’s deal secure the Chinese go ahead, SK Hynix will provide the company with most of the payment, yet the intellectual property transfer between the two will not be complete until 2025. In its report, Business Korea quoted unnamed analysts from China expressing confidence about a potential closing as soon as in the third week of December.

According to the publication:

Analysts say that China’s approval may come as early as this weekend or within this year at the latest.

The deal was announced in October last year, and since then it has not seen any significant regulatory hurdles. Intel plans to use the proceeds, from the initial $7 billion following approval, and then $2 billion following the March 2025 final closing, for a variety of areas, which its press release outlined as:

Intel intends to invest transaction proceeds to deliver leadership products and advance its long-term growth priorities, including artificial intelligence, 5G networking and the intelligent, autonomous edge.

An Intel graphic describing the Mask RCNN Tensor Flow machine learning object recognition model. According to Intel, the Mask RCNN is “a deep neural network aimed to solve instance segmentation problems in machine learning or computer vision. In other words, it can separate different objects in an image or a video. You give it an image. It gives you the object bounding boxes, classes, and masks.” Image: MaryT/Intel Community

An Intel graphic describing the Mask RCNN Tensor Flow machine learning object recognition model. According to Intel, the Mask RCNN is “a deep neural network aimed to solve instance segmentation problems in machine learning or computer vision. In other words, it can separate different objects in an image or a video. You give it an image. It gives you the object bounding boxes, classes, and masks.” Image: MaryT/Intel Community

At the artificial intelligence front, the company currently offers its Xeon lineup of processors, marketed broadly towards data center computing where they compete with AMD’s EPYC lineup. They were launched in 2019, and they are fabricated with the company’s renamed Intel 7 manufacturing technology. In terms of dimensions of the billions of transistors on a chip and the overall density per millimeter squared (mm²), this technology is comparable to the one marketed as 7-nanometer (nm) by Taiwan Semiconductor Manufacturing Company (TSMC).

TSMC is responsible for manufacturing the EPYC central processing units (CPUs) but only Intel’s Xenon has built-in AI acceleration. However, leveraging its strength as a CPU and GPU (graphics processing unit) designer, AMD offers its MI200 series high performance computing and artificial intelligence accelerators, which are built on a newer manufacturing process when compared to Intel’s Xeon. The MI200 series use AMD’s CDNA GPU architecture.

Xilinx announced its Versal Adaptive Compute Acceleration Platform in June 2019. Such platforms will diversify AMD’s product lineup should the deal go through. Image: Xilinx

Xilinx announced its Versal Adaptive Compute Acceleration Platform in June 2019. Such platforms will diversify AMD’s product lineup should the deal go through. Image: Xilinx

AMD Still Waiting On Chinese Approval For Xilinx Antitrust Remedies Believes News Agency

Apart from brief comments on the possible closing of the SK Hynix deal, Business Korea does not share any additional details. The sale comes as Intel, TSMC and Samsung deal with a historic semiconductor shortage that is expected to last throughout 2022 by some and steadily ease during the process.

If the Chinese authorities approve the deal then it might signal a relaxed attitude towards AMD”s bid to acquire Xilinx. However, the coast is not clear on the affair, according to a report from regulatory news services provider PaRR.

Picked up by SeekingAlpha, the paywalled report outlines that the Chinese antitrust regulator is still evaluating AMD’s proposals to address any potential antitrust violations. However, PaRR also outlines that authorities are progressing on the deal, but the publication does not assertively state that a December closure might take place.

AMD expects that the acquisition should close by the end of this year, and the deal entered the second phase of Chinese regulatory scrutiny earlier this year. In addition to an approval, the SAMR can also move the deal to third phase investigations, which will take place for roughly two months.

The post Intel’s $9 Billion Memory Sale Rumored To Secure Approval But AMD’s Xilinx Fate Uncertain by Ramish Zafar appeared first on Wccftech.